Chapter 1 - What is Online Accounting Software?

Online accounting has one goal: to help business owners track expenses and sales and facilitate the running of the business. The better a business can track its incomings and outgoings, the more likely it will be to control those two variables to maximise the profit.

Already use desktop accounting software? Go to Chapter 2: How Online Accounting Works

Why is accounting software better than a spreadsheet?

“If accounting is just a matter of tracking expenses in one column and sales in the other, why don’t I just stick with a spreadsheet?”

Before we look at online accounting it’s worth reviewing the merits of accounting software versus the trusty accounting tool of many businesses, the spreadsheet.

The short answer is that as a business grows the number and type of expenses (and sometimes revenue) expand. A sole trader adds staff and starts paying payroll tax, withholding tax, buying computers, office chairs and other equipment, and paying sales tax or duties in other states or countries.

The more entries in the expenses column the harder it is to see your biggest costs. And runaway costs are one of the biggest killers of businesses.

As spreadsheets become more complex, a business owner needs to spend more time keeping it up to date. For example it can take hours to enter receipts line by line into a spreadsheet. The same for copying details of sales invoices from Microsoft Word or typing in bank transactions into Excel. All three processes can be automated when you use online accounting software.

Lost time is the tip of the iceberg. Manual data entry is prone to errors. While it is worth checking all data – whether added manually or automatically – the probability of errors should decrease under an automated system.

Another major reason to move to accounting software is to reduce anxiety in sending information to the tax office. Accounting software automatically calculates how much tax a business should pay and it can electronically lodge tax forms for payroll and retirement or superannuation benefits.

The greatest loss to the business owner is the understanding of what is happening within your business. It is difficult to look up commercially useful information such as comparing sales over several years to spot seasonal differences. Or finding the top customers for a particular product this year compared to the previous.

While these tasks can be achieved using a spreadsheet, accounting programs can show you the answers in seconds and often without an accountant. Accountants and bookkeepers can help you interpret these reports into actions to grow your business, and accounting software makes it much easier to work with these experts.

Accounting software can increase the efficiency of a business through indirect ways too. For example it can connect very easily (and often for free) to many other business programs. You can pull up a list of customers from your accounting program and send them a special offer or your company newsletter through an email marketing app.

Or you may want to pass the details of customers who have bought items from your online store into your accounting program so you can match invoices to payments.

The money you save by sticking with Excel comes at a great cost. You miss out on the business secrets contained in your financial reports and the efficiency and productivity benefits of online software.

The advantage of accounting software

In one sense an accounting program is a complex spreadsheet with a much prettier interface. It has two major functions – recording financial data and creating reports to learn from it.

Let’s look at the types of information worth tracking in your business.

Sales invoices

Who owes you money? Have they paid? How much have they paid you this year compared to last year? These questions can only be answered by recording the invoices you send to your customers.

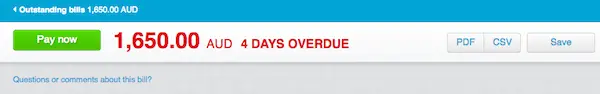

The information contained in sales invoices is critical to commercial survival. If you don’t know when you have asked your customers to pay then you and your business could run out of money. Plenty of businesses fail because they couldn’t manage their cash flow.

Online accounting software can also help you get paid faster through online invoicing.

For more on online invoicing, read Chapter 3: Making and Taking Payments

Bills and expenses

To whom do you owe money? When are they expecting it? Are you spending more money this month than last month? Tracking your bills is essential to knowing whether you are spending more than you’re earning.

Bills show your level of debt to your suppliers. Your expenses show how much you have paid already. Together these items show how much money your business is consuming in order to generate a revenue.

Strong businesses keep a close watch on their outgoings and make sure they don’t rise above a fixed percentage of their business.

Bank transactions

Invoices and bills show you the money that should be flowing in and out of your business. Your bank transactions show you the reality. This is where online accounting software really rises above spreadsheet accounting.

Online accounting software can automatically import streams of transactions from banks; these streams of information are called bank feeds. The bank feed updates the list of transactions each day and online accounting software can instantly match deposits to sales invoices and withdrawals to bills. This greatly improves the accuracy and speed of financial reporting over manually updating a spreadsheet.

For more on transactions, read Chapter 4: How Bank Feeds Work

Payroll

Once your business is large enough to hire employees the level of financial reporting jumps several notches. Now you have to worry about superannuation or retirement contributions, income tax payable, holidays and sick leave.

This complexity is handled easily by an accounting program and very badly by a spreadsheet.

For more on payroll, read Chapter 5: Paying Your Staff

Simple inventory

Many businesses maintain simple inventories on spreadsheets. An accounting program makes it much easier to track the number of items on your shelves or passing through your tills.

This simple or periodic inventory is included in most online accounting programs. Desktop accounting programs and online inventory programs have a more advanced inventory that shows which customer has bought an item and how many they bought previously. It can also show seasonal demand – a time of year when one product outsells others – and tell you when an item is running low. They can also track where the items are stored (in shops or warehouses) and other variables such as the age of foodstuffs.

Assets

Most businesses need things to operate. Cars and vans, furniture, machinery, buildings and other fixed assets are the cogs and wheels that run an enterprise. They need to be tracked and managed like everything else.

You could do this in a spreadsheet quite easily. Or you could record it in the one program will all your other financial data. Online accounting software again makes a time-consuming process simpler and faster.

A business can choose to store all these details in a collection of spreadsheets or replace them all with a single program. A good accountant can show you how to use the reports in your online accounting software to see incredibly valuable trends.

A sales report might show a new area of demand which will require restocking earlier than planned. An expenses report could reveal a cost blowout that must be reined in immediately.

You don’t need to run any reports to see key trends. All online accounting programs use a dashboard to summarise the most important information on a single screen. This can include the balances of your bank accounts, upcoming sales invoices and bills, a cash flow indicator, and highlighted spending or sales accounts.

Accounting software sounds like a good idea, right? But why use online accounting software and not desktop accounting software which you have to download to your computer?

Online accounting programs are popular because they combine the power of the spreadsheet with a format much easier to use by non-accountants. While many accountants still love the power of desktop software, business owners are much more likely to use online accounting software because it has been designed for them, not an accountant.

While there are many reasons why online software is superior to desktop software, in some cases desktop software is a better solution. To see the strengths and weaknesses of online accounting software jump to Chapter 6: Strengths and Weaknesses.

If you’re wondering how online accounting software works – where is my data stored, how do I know it’s safe? – then continue on to Chapter 2: How Online Accounting Works.

Chapter 2 - How Online Accounting Works

If you already use accounting software on a desktop PC you’re probably wondering what makes online accounting software so different.

Online vs On Your Desk

The biggest difference between desktop software and online software is where the software is located. Desktop software runs on your desktop or laptop computer (no surprises there).

Online software runs on a bunch of large computers called servers sitting in a big data centre. You need an internet connection to view your online software which you do with your internet browser.

This change makes a huge difference from a practical perspective and frees up users from a number of responsibilities. Here are the top four.

Easier to keep updated

Desktop model: The user is responsible for maintaining the software. That means any upgrades or patches to the business software must be downloaded and administered by the user or a colleague. If an update goes awry it is up to the user to restore from a backup and try again. And if you use the same program on your laptop, your home computer and your work computer you need to update it in all three places.

Online model: The software company is responsible for upgrading the software. Updates tend to happen invisibly without users knowing. All users are instantly upgraded to the latest version. (A caveat: Businesses moving from desktop software can sometimes find unannounced improvements disruptive when they alter established processes.)

Easier to run

Desktop model: The user must ensure that their computer is powerful enough to run the business software. This forces the user to upgrade their machine regularly to keep up with the requirements of more sophisticated software.

Online model: The software company must ensure that its servers are powerful enough to run the business software. This is much easier to manage in a data centre which has tons of spare computing power on hand. A user only needs enough computing power to run a browser. This is why you can use complex and powerful online programs through your smartphone. As noted previously, an internet connection is essential.

Easier to secure

Desktop model: The user is responsible for protecting the accounting software and its data. This means physical security such as locking the office door as well as backing up the software. Few businesses follow correct backup procedures which recommend on-site and off-site backups in multiple formats, or test whether restoring from those backups will work.

Online model: The software company handles all security of the software, including backup. Much of the cost of the security is split with the data centre which provides a base level of protection to all servers inside it. The software company also makes regular backups of all users’ software and restores the data as quickly as possible in the event of a major outage.

(A caveat: The terms and conditions for online software typically exclude software companies from compensating users for loss of data. Some users download key data from their online accounting software at regular intervals as a precaution.)

The end of versions

Desktop model: The user is responsible for maintaining compatibility between files and software. For example, accountants must maintain several versions of one desktop accounting program so they can open files sent to them by clients.

Online model: There are no compatibility issues with online software because only one version of the software exists at any one time (per country or region). Instead of sending files between two or more people you invite others to look at and work with your file containing your live business data.

A new way of working

The world of software is undergoing a slow migration from the desktop to online. Every software company from Microsoft down is shifting from desktop programs to online software – and in some cases stopping desktop software altogether.

Why? Every so often we have a major breakthrough in technology that causes a leap in productivity. The word processor which replaced the typewriter. The invention of the internet and email. The invention of handheld computing with smartphones and tablets.

Online software is another such leap. It is the next stage of the productivity boom unleashed by the internet and mobile computing. It is worth understanding what makes this boom so special.

There are five reasons driving the change.

Working together

It is much easier for two or more people to work together using online software. Instead of emailing or physically couriering a file, a user can extend invitations to others to view the exact same file. You can invite your bookkeeper or accountant to look at your file from their office while you’re talking to them on the phone. This speeds up the time it takes to troubleshoot, explain or advise on your financial data.

Less doublehandling

An accountant using desktop accounting software recreates your financial data in their own system. This is no longer necessary with online accounting software because the accountant works on the same file. This is often referred to as “common ledger” or “single ledger” accounting. This saves a lot of time and improves the quality of data shared between you and your accountant. This concept has been developing for a while but the multi-user access brought about by online accounting software has accelerated it. More traditional accounting firms may be reluctant to adjust to this process.

Working from anywhere

Online software can be viewed from any device with a browser. It could be in your office or in a hotel resort, on a desktop or an iPad. It means you never have to return to the office to look something up. Online software lets owners and employees work from wherever they are, whenever they want – as long as they have an internet connection. The trade-off is that if you're in a rural area or on a plane then you won't be able to use it. However, even planes are adding WiFi networks and coverage of rural areas will continue to improve.

More connected

It is typically difficult to share information in desktop software. Everyone has had to manually export lists and re-import them elsewhere. Online software can swap data with other online or desktop programs, automatically and often for free. This instant sharing eliminates repetitive data entry and makes sure everyone is working with the latest list of customers, products or invoices. Desktop accounting software can connect to other programs but the range of options is much smaller and the latest services (credit checks and postal address matching) are not available.

Continuous improvement

Companies that write online software no longer need to spend time supporting multiple versions of the one program. This frees them up to add more features to the existing program. The pace of development is much faster than with desktop software. Instead of an annual update, online software is often updated several times a year. Bugs can be identified and dealt with much more quickly.

Making Exceptions – The Hybrid Model

Not all software companies are abandoning desktop software. Australian software company MYOB has updated its AccountRight Live suite of programs to include many of the benefits of online software.

AccountRight Live has a mobile app, bank feeds, a mobile payments app and automated superannuation payments – features more likely to appear in an online accounting program. It has the added advantage of working online and offline as users can “check out” their information from the cloud by saving it to the desktop.

Compromises include requiring to download the software before opening the data file, and only then to PCs; the software doesn’t work on Macs or Android devices. First-time users of accounting software will also benefit from the productivity gains in newer interface design in online accounting software (whether made by MYOB or its rivals).

AccountRight Live suits users of desktop accounting software who want most of the benefits of online accounting software without changing the interface or their workflows.

To understand the pros and cons of hybrid software check out Chapter 6: Strengths and Weaknesses

The basics of accounting don’t change, whether running as a desktop or an online program. It can be broken into three components; general ledger for categorising your transactions, payroll for paying your staff, and managing your payments. Online software has made improvements in all three areas over desktop software.

In the next chapter we look at how making and taking payments with online accounting software can improve your cash flow.

Chapter 3 - Making and Taking Payments

Paying bills and collecting sales income are two critical functions in business. Accounting software does a lot more than simply record the transactions in a spreadsheet.

Collect Your Sales Income Faster

The way a business sends out invoices is changing rapidly. The usual method is to create an invoice in your desktop accounting software and either print it out for posting or attach it as a PDF to an email.

Some online accounting programs have already moved to online invoices (others are following suit). An online invoice is also sent by email, with the option to attach a PDF. However, the email also contains a link to view the invoice online.

When a customer clicks on that link the browser displays the invoice with a Pay Now button. Customers can click on the button and pay the invoice immediately with a debit or credit card or PayPal.

Either the online accounting program includes a payment gateway to process the transactions or the user must sign up with a third-party gateway.

Let's look at some of the advantages of online invoicing.

- Faster Payments. This ability to pay immediately has a measurable impact on the average time it takes to collect money from customers.

Businesses get paid twice as fast when they use online invoicing (1) and reduce the average time until an invoice is paid from 48 days to 33 days (2). That compares to an average of 55 days among businesses generally. - Better Bookkeeping. Online invoicing speeds up the bookkeeping too. Any invoices paid online are marked as paid in the accounting program and the transaction automatically reconciled.

- More Payment Options. As any retailer will tell you, the more payment options you can give a customer the greater the likelihood you will be paid. Online invoicing puts many payment options directly in front of the customer, whether you’re a services business or selling widgets.

- Pay on Mobile. Many business owners check their mobiles after hours or out of the office. Giving them the ability to view and pay an invoice quickly and easily from a smartphone or tablet is terrific. It is not just better cash flow but looks much more professional and modern than a paper invoice.

Pay Your Bills More Easily

Collecting money is crucial to cash flow. Paying your suppliers regularly is essential to staying in business too. Accounting software has been able to do this for a long time. Online accounting software has made some small improvements, with more likely to follow with tighter integration with online banking.

Batch payments, for example, long used to increase the efficiency of paying multiple suppliers, are typically saved into a file that has to be uploaded to an online banking portal.

Online accounting software aims to automate that upload process. Once a user creates the list of batch payments in their online accounting software they can push the list directly to their online banking portal for approval.

Few online accounting programs can do this and only then with a handful of tech-savvy banks. However, it is a priority issue for both banks and software companies and will become increasingly common.

Software companies have brought out a string of new ideas that make it easier to pay suppliers or process sales transactions. Some of the more recent and interesting developments are listed below.

Payments on Mobile Phone

Two accounting software companies have released their own mobile payment apps (MYOB PayDirect in Australia and Intuit QuickBooks GoPayment in the US). These give businesses the ability to take credit card payments on the spot. This is very useful for services businesses such as tradesmen and gardeners or mobile businesses such as market stalls.

The advantage of these mobile apps over standalone mobile payments apps such as PayPal or Square is that they can create invoices on the fly and reconcile payments automatically with the accounting software. The apps record all payment types including checks/cheques and cash so a business can maintain near real-time records of which customers have paid.

Send International Payments

It’s not just importers who need to pay overseas these days. Many companies are using online services provided by suppliers in the US, Asia, Europe and Russia.

The payments process is more complicated when it comes to international providers. In most cases a business will pay through their bank, often using the online banking portal. Banks charge a lot of money for this service compared to bank fees on domestic transactions.

Recent innovations by one online accounting program make paying overseas suppliers much cheaper and easier.

A Saasu user selecting an international bill for payment within Saasu is taken to a third-party foreign exchange. The exchange gives the invoice a competitive rate with a lower transaction fee than the banks and transfers the payment from the user’s bank account.

The invoice is then marked as paid in Saasu and the transaction reconciled automatically.

Track Bills Better

The standard format for bills sent electronically is a PDF. Unfortunately this is not a simple file from which to copy and paste information into your accounting program.Receipt processing apps can scan PDF invoices sent to a business email address and import the information automatically into an online accounting program.

MYOB has built this functionality into its AccountRight and Essentials accounting programs. They use optical character recognition to identify the contact, the business registration number, item details and costs, and tax included.

The software then creates a draft bill with all these details for approval. This helps track upcoming liabilities and plan cash flow.

Masters of the Coin

Registration with a payment gateway service is required to take payments from customers using online invoices. These gateways process debit and credit card transactions instantly although they can sometimes take several days to transfer the money to your bank account.

The most well-known is PayPal which can accept a huge range of currencies and is a trusted supplier. Other services such as Ezidebit, Authorize.net, DPS, POLi and others offer escrow, custom branding, cheaper fees or bigger business networks. Intuit QuickBooks can even accept payments in the virtual currency bitcoin.

The main criteria for evaluating a payment gateway are accepted currencies, the cost of transaction fees and the number of days from payment to withdrawal.

There are a lot of new ideas about how to improve modern accounting. Read on to Chapter 4: How Bank Feeds Work if you want to know more about one of the best – bank feeds.

References

1. QuickBooks Payments (Intuit)

Chapter 4 - How do Bank Feeds Work?

One of the greatest innovations in accounting, bank feeds have heavily reduced the amount of data entry in a business. The method of collecting these feeds differs between software and banks; this chapter looks at what happens behind the scenes.

What is Bank Feed?

A bank feed is an automatically created list of the transactions (spent and received) in your bank account. Bank feeds have been around for a while as part of desktop accounting software. They were integrated into online accounting software only in the past couple of years.

The impact of bank feeds for small businesses has been enormous. Accounting programs can automatically match a transaction in a bank feed with a sales invoice awaiting collection or a bill awaiting payment. This cuts out hours of manual data entry required to reconcile accounts.

Why are Bank Feeds So Important?

A large part of SME accounting is coding bank statements into revenue and expense categories so a business can track its sales and costs. A user can set up rules to automatically match transactions from certain suppliers (eg. a credit card transaction from an airline would be categorised as Travel). This coding occurs from within the bank reconciliation screen which is more efficient than older methods.

Online accounting software collects bank feeds in two ways.

1. The Direct Feed

Larger software companies pay the biggest banks to receive bank feeds for shared customers’ accounts. The bank’s IT department prepares its systems to export a daily feed of transactions from its banking system to the software company’s databases that run the online accounting program.

The software company can pay millions of dollars a year to a single bank for these feeds. These costs are usually absorbed by the software company and not passed directly to the customer.

2. The Indirect Feed

An online accounting program can also use a data aggregation service which collects bank feeds from thousands of banks.

The data aggregator used by most software companies is a US headquartered company called Yodlee. Yodlee sidesteps the cost of paying for fees by copying the list of transactions on the screen of users’ online banking portals.

Yodlee cleans up the list, removes duplicates and sends it to the user’s online accounting software as a bank feed.

This process is called “screen scraping” and initially created some controversy for two reasons.

The technology is not perfect and the occasional transaction is duplicated or omitted. Online accounting programs that use Yodlee recommend checking reconciled accounts against the balances in your online banking portal.

Secondly, Yodlee requires users to share their login details to access their online banking portal. Competing software companies have claimed that sharing login details breaches the terms and conditions for accessing an online banking portal.

Users need secure payment processing when buying Cialis generics online, this feature is provided by major banks.

Are Yodlee-Created Feeds Safe?

Yodlee says its processes for collecting bank data are widely accepted throughout the US, Australia and other parts of the world. It collects data from more than 100,000 bank accounts in 14,000 banks and other financial institutions, and hasn't reported any security breaches in the past 15 years. (1)

Yodlee is registered as a tier one financial institution in the US which means it must comply with the same security and regulatory obligations as the largest American banks, such as Citibank and Bank of America, its first two customers. One of the largest twenty banks in the US uses Yodlee to compile bank feeds from their own systems to create a system of record for internal reporting. (1)

Should You Use Yodlee-Created Feeds?

Bank feeds can save an enormous amount of time and increase the speed of doing business by keeping your accounts up to date. It is worth setting up Yodlee feeds to understand how it can increase efficiency and cut down data entry.

Yodlee works better with some financial institutions than others. Best practice is to compare the reconciled balance in your online accounting program with your online banking statement to find omitted or duplicated transactions.

In most cases, particularly for the bigger banks, a Yodlee feed will work fine. If you are with a smaller institution and the number of inaccuracies is too high then you will need to weigh the cost versus the benefit. A good bookkeeper will know whether the bank feed is worth keeping.

It’s worth noting that Yodlee is working to improve the quality of its feeds with smaller banks. It may be worth checking every six months to see if accuracy has improved.

Alternatives to Yodlee Feeds

There are alternatives to Yodlee. In Australia and New Zealand MYOB has operated an identical service for the past 25 years called MYOB Bankfeeds (previously an acquisition known as BankLink). It claims to have an accuracy rate many times higher than Yodlee – the likelihood of an error is 0.0001% compared to 0.1%. MYOB says it uses algorithms to ensure near 100% accuracy and guarantees no duplications or missing transactions. (Yodlee says MYOB's accuracy claims are not possible.)

MYOB has also signed agreements with all its banks – no user passwords required, allaying any concerns about breaching bank conditions. However, MYOB Bankfeeds are only available for financial institutions in Australia and New Zealand.

Intuit also operates a similar service to Yodlee for the US market.

Bank feeds take online accounting software from a system of record to a daily snapshot of your business. The efficiency in recording transactions is replicated in another key area of accounting software – payroll. Read on to see how much easier it is in Chapter 5: Paying Your Staff.

References

1. Yodlee Opens Up on Bank Feeds – Interview (Digital First)

Chapter 5 - Paying Your Staff

Paying wages can be a highly complicated process if you employ casual staff working to rosters. Even managing full-time employees requires staying on top of retirement benefits (super), leave and overtime. Much of this can now be automated by the latest accounting software.

What is Payroll?

The ability to calculate wages has long been a feature of desktop accounting software. Despite this, some businesses continue to use spreadsheets to pay staff. This approach can cost the business heavily in time and accuracy.

A general-purpose spreadsheet must be manually updated, increasing the risk of miscalculating income tax, superannuation or number of hours.

It is also a painfully slow method for paying staff. Businesses end up juggling spreadsheets for timesheets, leave accruals, tax tables and completing compliance forms at the end of the year.

An accounting program has a purpose-built section called payroll which records the bank account and superannuation details of all employees, the number of hours worked and their pay grades or rates.

A business owner can eliminate a boring, manual process with payroll which is always up-to-date and compliant, and pay staff quickly and easily. Businesses which get their payroll wrong can face large fines from industrial relations bodies or the tax office.

Another advantage over spreadsheets is that payroll transactions automatically update parts of your accounting software (and more automation is coming). For example, reports such as Profit & Loss and Balance Sheet will reflect the impact of money moving from the business’ bank accounts to your employees’.

What is New In Payroll?

Online accounting software has brought a number of improvements. Desktop accounting software requires an annual update for tax tables for calculating income tax payable, superannuation guarantee rates and other levies. In the past this process has been so troublesome some businesses have hired experts to manage the upgrades for them. (Newer desktop programs have greatly improved the download routine.)

Online software by contrast updates itself automatically and invisibly so a business is always paying the correct amounts of tax. These updates can occur at any time, allowing the software company to add improvements year round.

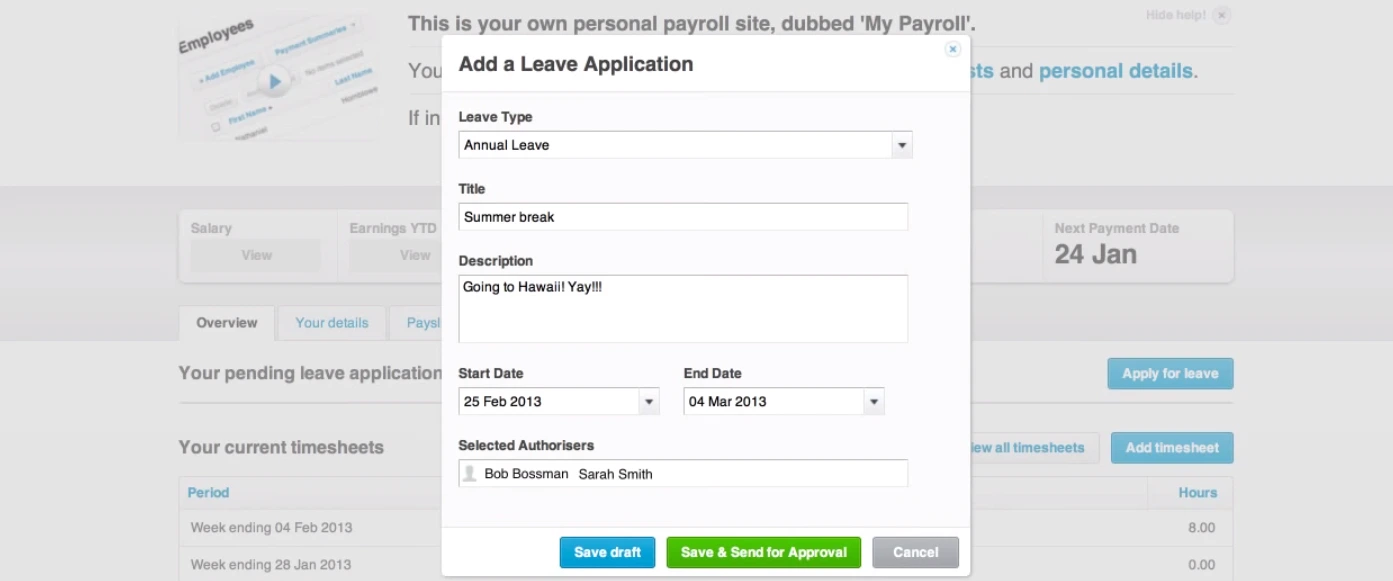

Online software has also made it easier to track attendance and calculate wages with new features such as timesheets on smartphones. Some accounting programs offer a basic payroll for paying staff and a separate module for more advanced payroll. Below is a list of features available in online accounting software; the options vary by program.

Online Forms

The latest accounting software (desktop or online) can upload employee forms such as tax file number declarations directly to the tax department. Most can also send payment summary annual reports directly to the tax office too.

Online Portals

Employees can use online portals to apply for leave and view details such as timesheets, pay slips, leave balances, payment summaries and so on. Managers can also approve other employees’ leave without seeing the rest of the business’ financial information. Online portals let employees look after their own affairs and reduce the number of requests to your finance person.

Timesheets to Hours Worked

Employees can use their own online portal to record timesheets. It then automatically turns the time and attendance details into wages, reducing the chance of errors in manually typing in the hours. This also makes it easier to see how many hours your staff have worked that day and the net profit after sales.

Pay Staff at Different Times

Payroll apps can use multiple pay calendars so you can pay some staff weekly and other staff fortnightly or monthly. Online accounting software is sold as a single subscription and doesn’t limit earnings, deductions, reimbursements and leave types.

Automatically Connect to Other Programs

Online accounting software can swap payroll information with timesheets, employee scheduling, HR management and costing apps. Desktop software can do this too but has fewer options than online.

Superannuation

Accounting software in some countries (for example, Australia) can automate retirement or superannuation contributions for employees. Instead of paying out amounts to each individual, all contributions can be paid with a single click through a clearing house.

The smarter applications automatically calculate thresholds and caps ensuring the employer is not paying superannuation when it's not required. This can save employers a considerable amount of on-costs when paying their staff.

Advanced Payroll Features

Businesses with full-time and part-time employees will most likely be happy with the payroll features in online accounting software. Specialist payroll apps that connect to online accounting software add more powerful tools.

Pay Conditions Calculator

This calculator automatically calculates how much an employee should be paid. It takes into account the time of day (day or night shifts), day of week (week or weekend), number of hours worked, time between shifts, shift allowances, public holidays and so on.

The calculator comes with pre-built rules based on government awards which automatically update each year. Pay rate templates cover standard rates, penalty rates and allowances for each age bracket and classification.

Businesses can also create custom rules for unique salary agreements.

A payroll app can automatically apply pay rate increases every year, on a birthday or the anniversary of a qualification.

Clock-On/Off Tablets

Payroll apps can turn a tablet such as an iPad or Android device into a time and attendance “kiosk”. Employees can clock on or off using the tablet when they start and end their shifts.

The kiosk automatically creates timesheets based on the employees’ entries and updates the online accounting software.

This is for larger businesses that want to have a fixed location for clocking on and off. Otherwise, employees can use the online portal in the company's online accounting software using their smartphone.

Create Rosters

Staff rosters are far more easily managed in an app than on paper. Payroll apps let employees set their availability and view published shifts from a self-service portal on their smartphone. They also make it easy for managers to compare scheduled shifts to submitted timesheets before approving them.

A business can calculate the cost of a shift based on the awards and pay conditions of the employees rostered to work that shift.

Despite all the advances introduced by online accounting software there are still some areas where desktop accounting software is a better choice. Read Chapter 6: Strengths and Weaknesses to find out which is best for your business.

Chapter 6 - Strengths and Weaknesses

No new technology is a silver bullet. It will contain breakthroughs that drive its success but there are almost always tradeoffs. Every business must weigh up, case by case, whether the advantages are worth the pain of lost features. Here’s what you will like and dislike about online accounting software.

Why You Will Like Online Accounting Software

Accountants and bookkeepers who have adopted online accounting software as the cornerstone of their practices are very vocal about the benefits. The list below was compiled from several sources on LinkedIn and comments on Digital First.

1. Intuitive and easier to use. Online accounting software has been designed in the age of Facebook and the iPhone. Software companies put a lot of effort into how easy their business software is to use.

This is not just window dressing. A business owner who feels comfortable using their accounting software is more likely to have greater knowledge and control of their finances.

The best example of good design in online accounting software is the use of a dashboard as the opening screen. It summarises and displays the most important information in a single page.

Although dashboards first appeared in desktop software they weren't used as the opening screen because they weren't easy enough to use.

2. Automated data entry. The latest accounting software has eliminated the need for manual download and import of bank statements from your online banking portal. Instead, bank feeds send transactions daily straight into the accounting program.

A business can set up rules that automatically code receipts from stationery suppliers as office expenses. Online accounting software can automatically scan bills and copy individual line items, due date and total owing. Not only is account reconciliation much faster, it reduces the expense of paying a bookkeeper to enter all the data.

Automation removes human involvement which reduces the chance of errors. (Errors are not eliminated totally as there are sometimes exceptions, changed circumstances or rules applied wrongly.) This is an area of rapid innovation and most of these new features are only appearing in online software, not desktop.

3. Real-time business management. The automation in data collection opens the door to a new concept – reviewing your finances in near real time.

Business owners typically expect their desktop accounting software to run months behind. By comparison online accounting software can be reconciled daily, which makes monthly close-outs easy.

This transforms accounting software from a system of record to a rich source of business intelligence. Ask the right questions of your accounting software and the answers will help you find more sales, avoid cost overruns and run a more profitable business.

4. Real-time advice. Now your data is up to date and you’re using your online accounting software to see what is happening in your business. This is a great time to ask a financial expert what the numbers mean and the fastest or easiest way to increase them.

More accountants are seizing this opportunity to offer real-time advice and are branching out from tax returns into advisory services for business owners.

Instead of charging by the minute, some accountants offer a fixed-fee package that includes phone calls and monthly or quarterly consultations to coach you in growing your business. The accountant and business owner just log into their own browsers and can immediately review and discuss the same set of accounts.

5. Better security. Online accounting software is operated by large data centres operated by global technology companies. These data centres are far better protected than the average business server, with armed guards, 24-hour monitoring and the latest security technology.

Online accounting software is also far more reliable than desktop software; the former may experience several hours of downtime, often for upgrades and bug fixes, in a whole year. There is only one (country-specific) version of an online accounting program – everyone is upgraded simultaneously. This means accountants no longer need to keep multiple copies of an accounting program to open files from older programs.

If your computer crashes the accounting data file is unaffected. The business owner no longer needs to worry about backing up the accounting file either, as this is handled by the software company too.

Online programs can also go offline but this is very rare. The most popular accounting apps report their total time offline as less than eight hours in a year. (1)(2)

To find out more about security and online accounting software read Chapter 7: How Secure is Online Accounting Software?

6. Easier to expand. Online accounting software connects to other types of online business software very easily. You can sync your customers with an email marketing program to send them specials or with e-commerce software to record sales through your website. These connections are usually free or a low monthly cost. Some of the latest desktop software can connect to online software too, although businesses on older versions will not have the option.

Online accounting software is easier to use across different devices, whether smartphone, tablet, PC or Mac. Compatibility issues are extinguished because the software runs in the browser, independent of the operating system of the device.

Why You Won’t Like Online Accounting Software

There are some strong practical reasons to stick with desktop accounting software – the depth of features, for example. However, many reasons are also emotional. Older business owners feel more comfortable knowing that their information is within their control.

1. Too expensive. Online accounting software is sold under a different model to most desktop accounting software. Instead of buying it outright (a perpetual licence) the software is rented on a monthly basis. This can quickly end up costing much more. Older desktop accounting software includes a licence to operate five entities which makes it very cheap to track a trading company, holding company, trusts and partnerships. Online software and the latest desktop software usually only provide one licence for one entity.

True or False? True when comparing purchase price. The difference is less once efficiencies of online software are taken into account. Automation can slash the amount of bookkeeping, saving thousands of dollars a year. It’s also possible to get extremely cheap (sub $5/month) online ledgers through accountants for non-trading entities.

2. Fewer features, more limitations. Most online accounting software is less than 10 years old. Desktop accounting software is often more than 20 years old. The depth of features reflects this difference in maturity. Advanced features are more easily found in desktop software. (Online accounting software with the same set of features often costs significantly more as it is sold as cloud ERP, or enterprise resource planning software.)

True or False? True, although the gap is closing every year. Weaknesses in online software include complex inventory, payroll and restrictions on the number of employees. Online accounting software can connect to specialist apps with these features at an extra cost.

3. Speed. Desktop software is generally a lot faster than online software. This is particularly true for data entry, and bookkeepers and accountants often complain that they can’t work as fast in an online accounting program.

True or False? True, although this is likely to matter less over time. Improvements in browser technology and increases in the speed of internet access are already closing the speed gap with desktop software. Developers say the difference will soon be negligible.

Also, the amount of data entry in modern accounting software is dramatically reduced by bank feed automation and invoice scanning services. The key is to find an advisor who can set up your online accounting program correctly the first time.

4. Less control of data. One of the more emotional concerns is about the storage of accounting information. Older business owners can be afraid of losing control of their data. Accountants have long been the trusted holders of accounting files and some are reluctant to relinquish that role. Software companies sometimes store data in data centres in another country with different intellectual property laws.

Younger, online software companies may not survive. What happens to the data if the company fails? It’s a valid question. However, it’s also worth noting that in the technology industry, older companies are sometimes disrupted and driven out of competition.

True or False? True – a business has less direct control but the data may be safer as a result. The best answer is to think of software companies in the same way we think of banks. Just as we trust a bank to hold and secure our money, we expect a software company to hold and secure our data. In both cases we are trusting third parties to mind intangible assets on our behalf. There is definitely an element of risk but businesses are overwhelmingly deciding that the benefits outweigh it.

5. Reliance on the internet. Online business software requires an internet connection. Without it you’re out of luck. This makes it unsuitable in places where internet access is unreliable or too expensive.

True or False? True. Some businesses in this unfortunate position have decided that the efficiency of online business software is so important that it is worth installing optic fibre or microwave links to ensure internet access. Otherwise it’s a case of waiting for telcos or government to improve coverage.

6. Vulnerable to hackers. Some businesses believe their data is more susceptible to attacks by hackers because it is stored “on the internet somewhere”. This is more perception than reality.

True or False? False – cloud software is much better protected against the majority of common threats than desktop software. There are many stories of security mishaps with servers operated by small and medium businesses. Viruses, trojans, ransomware, theft of data by employees – these are regular occurrences when businesses look after their data themselves.

However, very few if any of these reports relate to the types of data centres operated by software companies. To date there have been hardly any successful, published attacks on or theft of data from online business software.

Why You Might Prefer Hybrid Software

MYOB's AccountRight Live is difficult to categorise. It is desktop software that saves the data file to the cloud and (optionally) to the desktop. It is the only example of the hybrid model but it has a place in the Australian and New Zealand markets.

As a hybrid it enjoys most of the benefits of online software and some of the advantages and disadvantages of desktop software. These are the main points of difference for AccountRight Live (ARL) which is offered as a subscription service.

1. Stability and Speed. ARL can be used offline which makes it a good choice for places with poor internet access. The cloud-based data file can be set to sync with the desktop file so that if the internet cuts out the user can keep working. The user can carry out conventional data entry tasks much faster as there is no delay when saving to the desktop file.

However, ARL doesn't work well on older PCs with slower processors; it works best on new, fast PCs. Users have complained that the software is slow to save to the cloud data file although MYOB claims it has resolved these issues.

2. Features. ARL is a cloudified version of MYOB's long-standing desktop software. It has all the conventional features a business needs including payroll, advanced inventory and extensive reporting. It also has features in online software such as bank feeds and the ability to share information with your accountant online.

3. Interface. ARL has retained MYOB's user interface from previous versions. This is an asset for business owners and accountants migrating from older versions of MYOB who want to maintain their existing processes and avoid dealing with change. It is a drawback for businesses wanting to take advantage of improvements in interface design and user experience. Online accounting programs such as MYOB Essentials and others are much easier to use for business owners.

4. Control of data. One reason businesses and accountants choose ARL is because they can save a copy of the data file to their own computer. This removes the risk of an online accounting software company going into administration. It also lets users keep a copy of their data at any point in time. They can take a snapshot of their accounts for record keeping or audits and keep the file without having to pay an ongoing subscription.

5. Connectivity. ARL can connect to an extensive range of online business software and to mobile apps such as MYOB's mobile payments app PayDirect.

However, it can only run on PC desktops and laptops. It can't run on Macs, smartphones or non-Windows tablets running Apple's iOS or Google's Android operating systems. A user must download the ARL software to a PC before they can open the data file.

Security remains one of the primary concerns in moving to online software. The idea makes some business owners uneasy because with online software they can’t see the server running underneath their desk.

The reality is that online software has far greater protections in place than the vast majority of servers sitting in offices of small businesses. In Chapter 7: How Secure is Online Accounting Software? we look at how online software is secured.

References

1. See Saasu's live uptime dashboard as an indication of the reliability of online accounting software.

2. In 2012 Xero had 99.97% uptime. Xero Stays Scalable, Resilient in the Cloud (ZDNet)

Chapter 7 - How Secure is Online Software?

One of the most common questions about online software is security. If I can’t see the server that runs the program under my desk, how do I know if my business information is safe?

Measuring the risk

A security company once said the only safe computer is one that has been switched off. All software, whether it runs on your desktop or online, is vulnerable to security threats. This doesn’t stop businesses from using software. Software is indispensable to running an efficient, modern business and communicating with your employees, customers and suppliers.

Instead of asking, “is online software secure?” a better question is, “is online software more secure than desktop software?”

For the vast majority of small and medium businesses the answer is yes. To understand why we need to look at the vulnerable points in the process of using software.

Desktop software

The points of vulnerability with desktop software are all located in one place, the desktop or laptop computer. It is the point of access for the user, the point of storage for the accounting software and the user’s data file, and the point of connection to the internet.

The level of security for desktop software comes down to the initiative and budget of the user.

Most businesses spend very little on security, whether electronic measures such as firewalls and anti-virus protection or physical measures such as locked doors and anti-theft cables. They also tend to spend little time or money on educating staff about best security practices.

The reality is that an office computer is usually vulnerable to a greater range of internet-based attacks than online software. And it is much more vulnerable to physical risks such as fire, flood or theft.

Not only is the software often poorly protected, the emergency processes to restore the software are usually lacking too. Backup is the great Achilles heel of many businesses who usually treat it as an afterthought. When something does go wrong it can take many hours or even days to return to full operation.

Online software

The points of vulnerability for online software are split between the vendor and the user. The point of access for viewing the software (whether laptop, desktop, smartphone or tablet) is still the user’s responsibility to secure.

Storage of the accounting software and the data file is not the user’s responsibility but the vendor’s. Software companies run their programs from enterprise-grade data centres with highly sophisticated, layered defences.

These enterprise data centres are patrolled by guards and access is controlled by keycards and fingerprint and iris scanners. Other physical defences include firefighting systems (gas and sprinklers), large diesel generators to supply power during blackouts, and flood-resistant locations.

Data centres usually have multiple, redundant, extremely fast internet connections. The networks are protected by the latest security technologies and 24-hour monitoring by a team of IT security experts.

There’s also security in obscurity; the data for one business is stored on the same server as hundreds of other businesses.

If a server fails in an enterprise data centre it can automatically push an online business application from one group of servers to another.

Online software companies have detailed backup procedures for restoring their applications if a software bug causes a crash. The average amount of downtime for the best-known online business programs is several hours in a whole year.

How hard is it to secure?

Rows of servers inside a Google data centre. Source: Designboom.com

Whether the threat is theft, natural disaster, a virus or a hacker, online software is generally far better protected than a desktop program. If a thief steals a smartphone they won’t be able to access the online software without entering a password.

A business owner could log in from another computer and change the password in their online accounting software and it would be impossible to access from that smartphone again.

If a thief steals a laptop they have a much greater chance of opening data files in any desktop software it contains.

In the past hackers have tried two main approaches to hack into online software from the user’s computer. They use password-guessing programs that cycle through billions of combinations until they find the right one. This is called “brute forcing”.

Or they snoop on a network and capture the password as it passes between your computer and the data centre where the online software is located.

These two types of attack are almost impossible against online accounting software sold by mainstream vendors today. The security practices banks use to protect online banking services to millions of customers have become standard practice for protecting online business software.

The login screens for online accounting software limit the number of times you can attempt to enter a password. If you try too many times it will lock your account or suggest you reset your password.

The second attack, network snooping, is also easily defended against. Online accounting software forms an encrypted tunnel between a computer and the data centre. Any information such as a password or your account balance passing up or down the tunnel is unreadable to anyone else.

The most successful forms of attack have nothing to do with online software itself. The weakest link is usually the user, and hackers target them accordingly.

Far too many people use one password for all programs. This means that if a hacker steals a list of passwords from a small business which counts you as a customer, they will try that password and email address in your Gmail or Yahoo account, banking and other online services.

The second attack is called social engineering. This can take multiple forms but its common goal is to encourage you to reveal your password. One method is to email a link to a fake website, such as a bank’s online banking or a payments gateway such as PayPal.

Or a hacker could phone you and impersonate your bank and ask for your password as part of the verification process.

You can minimise the risk of attack in several ways.

- Use a unique, difficult to guess password and keep it in a very secure location.

- A password manager is a very handy tool for creating and storing long and difficult passwords for many websites. Of course, you need to have a very secure password to access the password manager but at least it’s the only one you need to remember.

- Never reveal your password to anyone, even if they are allegedly calling from the bank or software company. If someone does ask you for your password it is almost always with malicious intent.

- Only use your own laptop or computers rather than public computers.

- Public wifi networks in cafes and airports can be compromised. For maximum security use your smartphone or tablet, or tether to them with your laptop, to access your online accounting software. Telcos tightly control access to their networks which makes them more secure.

One specific area of concern deserves its own chapter. What happens to your company file when you move from desktop accounting software to online? Read Chapter 8: Looking After Your Data to find out more.

Chapter 8 - Looking After Your Data

The way desktop accounting software handles our financial data is very familiar. It sits in the company file which a business can physically share with their accountant or bookkeeper. When it comes to online software, data is a much more nebulous and powerful concept with enormous potential.

The journey of the ledger

At the close of every financial year a business owner sends their desktop accounting file to an accountant who copies that file into their own accounting program. They then review and correct the data, create reports and send the required information to the tax agency. In some cases the accountant then sends the updated, corrected file back to the business so they can update their own records.

Accountants expect the business’ information to exist in two places; the business owner has a copy and the accounting firm keeps its own copy. Most accountants only care about their own copy as it is “the source of truth” from which they calculate tax obligations. It is also the file which the tax agency will audit if a dispute arises.

Online accounting software dispenses with the need for two copies. The data file is not stored by the accountant or the business owner but by the software company. Anyone with permission can view and edit the file no matter where they are located. All they require is an internet connection, a computing device and a username and password.

Software companies call this a single, common or unified ledger.

Business owners, accountants and bookkeepers can find this concept confusing and confronting. Unfortunately some accountants assume single ledger refers to single-entry bookkeeping, when it is in fact an evolution of double-entry bookkeeping.

The single-ledger approach has been universally adopted by all accounting software companies and will eventually replace the two copies required by desktop users. Storing the database that sits within every company file online opens the door to radical efficiencies. It also raises some important questions about who owns the data in the company file.

Who owns your data?

This is the first question many businesses ask when they consider moving to online accounting software. The terms and conditions for all online software companies state that although they store the data it remains the property of the subscriber.However, it pays to check the fine print.

Accountants sometimes hold onto desktop accounting files and refuse to send it back until clients pay their accounting bill. This is a practice from medieval times called lien – a merchant can hold onto property sold to a buyer until they have received payment.

While accountants can’t withhold access to online accounting software, some software companies support their right to refuse to transfer control of an online data file to a different accountant until the business owner has paid their bill.

This happens very rarely. Such incidents have prompted online accounting software companies to clarify that the business always retains control of their file, regardless of who pays the subscription. In any dispute between an accountant and client the software company will give the business owner full control of their data file.

Xero is the only major software company which still recognises the subscriber as the owner of the data file, even when the accountant is holding the subscription on behalf of the business. Xero says its terms state that the ownership of the file is the subscriber and that it won't get involved in disputes between accountants and their clients.

The safest and best practice is to make sure the subscription is in the business’ name, not the accountant. That way the business always remains in legal and practical control of the data.

How do I get my data?

A business may want to change from one online accounting program to another or, if the business is closing, stop using accounting software altogether. All programs give users the ability to download information into spreadsheets. Unfortunately it is often a small subset of all the data contained in the accounting program.

This is one of the weakest links of online accounting software. Software companies have little incentive to make it easy to leave their programs.

Third-party data migration services can move you from one accounting program to another relatively easily, although not all forms of data may be brought across.

If you are closing down your business you will need to retain your data for a minimum number of years. You can either download the reports and balances to spreadsheets instead of continuing your subscription.

If you would rather keep paying a subscription, ask your accountant to downgrade your file to a ledger or cashbook which costs a fraction of the full business accounting editions. If the business starts up again the edition can always be upgraded.

Ways that data can help you

Accounting data is incredibly powerful and valuable. Businesses have rarely taken advantage of its full potential. Online accounting software hopes to change that by making it easier to read and cross-checking it with other sources to make it far more useful.

One of the great advantages of online accounting software is that now the database holding your financial information is on the internet you can pull data from or push data to other databases. Why would you want to do that?

Here are some examples of things you can do now or do soon with online accounting software, depending on country availability.

- Business addresses. Your online accounting program can verify the address of a new supplier or customer when you are entering them into your contacts. The program checks the address against a government database such as the national postal service or a third-party database such as a phone-directory business. Now you know that any invoice mailed to the customer should arrive.

- Business loans. Several startups have launched funds that provide crowd-funded finance to high-risk businesses. These should make it much easier for small businesses to raise money than going through a traditional bank. Micro lenders have partnered with accounting software companies in the US and Australia.

- Tax details. In some countries the national tax agency can automatically fill fields in your online tax forms. It uses payroll and other tax information gathered throughout the year and sends it to your online accounting program.

- Business registration. Companies often fail to check the business registration number for a customer or supplier. Online accounting software can check a government database to see if the registration is valid and whether it matches the trading name.

- Credit checks. Online accounting software can run a credit check on a customer or supplier through a third-party database and tell you whether they are in good financial standing. You can then set your terms for payment accordingly.

- Benchmarking. Online accounting programs used by thousands of businesses contain an enormous amount of information. Software companies will soon add benchmarking services where businesses can compare their financial performance against an anonymised average compiled from other businesses of the same size, in the same industry or in a similar area.

How to share your data with other programs

It is relatively easy to pass information from one online database to another. There are many, many options to send and receive data in both directions which can open the door to great efficiencies in your business.

Here are some of the advantages to connecting to other online business programs.

- Automatic syncing. When you connect an online accounting program to another online business program it can update it automatically. This can be daily, on-demand or in real time.

Automatic updating with online software usually replaces the export-import routine used to manually transfer information between older desktop programs. Manual processes often fall behind resulting in multiple or incomplete versions of data in different programs. This can result in lost sales, wrong postal addresses and unhappy customers.

Online software can sync data such as addresses so that you only need to update an email or street address once and the change is pushed to other programs. Not all online software syncs data two ways; check whether it pushes or pulls data or does both. - Specialised tasks. An explosion of software startups has created hundreds of niche applications that will solve a problem for a particular industry, from bike shops to architects to farms. There is online software for specific tasks too, such as point of sale, complex inventory, HR and productivity suites.

A huge amount of innovation is expanding the world of online software; in some cases your online accounting program can connect to it or it might be a separate application. - Free to connect. Often the cost of connecting two online programs is zero or close to it. Online accounting programs have ecosystems of hundreds of business applications which will share some type of data freely. Online integration services such as Zapier, IFTTT and OneSaas can extend the number of programs you connect to for tens of dollars a month.

So what type of online business programs can you connect to? Here’s a list of activities performed by software that connects to online accounting software.

- Automate your payroll

- Send a newsletter or email

- Automatically scan receipts or bills

- Track sales deals and inquiries

- Manage support requests by customers

- Automate notifications to debtors

- Send well-designed sales proposals

- Track employees in the field

- Record sales made by your online store

- Record sales made by your point of sale register

- Track time against projects

- Analyse your financial or other business metrics

One question every business must answer is which application should be treated as the source of truth. In other words, if there is a conflict in information between two programs, which should be trusted?

Predictably, online accounting software companies are keen to establish online accounting software as “the operating system” for business. However, a retailer may see their point of sale software as the primary record of the most important data to their business.

Online accounting software can have an enormous impact on how well a business tracks and manages its finances. Your accountant or bookkeeper should be able to talk about the benefits of the different programs available.

Thank you for reading this guide. We here at Digital First hope that it has helped you understand how this software works and the difference it can make.

Please share this guide with any friends or colleagues who might find it useful by using the share buttons at the top of this page.

Recent News

Featured Guides

Explore other guides in our collection covering new technology, ERPs and more.

Select the next module below, or go back to view the others.